Product Videos For Amazon [Everything That You Need To Know!]

Are you looking for the best way to enhance your Amazon product listing to stand out among the compe ...

As a minor or a temporary resident, it could be difficult to sell online without a Social Security Number, or SSN. But it is not impossible. There are a few ways in which you can make money online without an SSN in the U.S.

Here, the most eligible way to sell without an SSN would be to use the Individual Taxpayer Identification Number (ITIN) or Employer Identification Number (EIN). You can also choose alternative platforms that don’t require any SSN.

However, there are several options you can choose to start a business online without paying your SSN. It may also require some precautions. So, let’s see how to sell online without SSN.

The word SSN stands for Social Security Number. It is a nine-digit identification number that is assigned to individuals by the Social Security Administration (SSA) in the United States.

At first, President Franklin D. Roosevelt approved the Social Security Act into law in 1935. It was aimed at providing a social insurance program for retired workers, the unemployed, and the disabled.

Later, as part of the Social Security program, the government introduced the concept of Social Security numbers. Initially, they were used solely for tracking individual accounts.

The other uses of an SSN are:

Yes, you can sell online without an SSN or Social Security Number in some cases. Many online platforms and marketplaces allow individuals to create and operate seller accounts without providing an SSN.

However, the ability to sell without an SSN can be different depending on the country and platform.

In the United States, for example, selling on popular e-commerce sites like Amazon or eBay generally requires providing tax information, including an SSN or EIN.

However, there are alternative platforms that do not require an SSN, such as Etsy, where you can sell handmade or vintage products.

Outside the US, countries may have different requirements for selling online. Some platforms may ask for a national identification number or tax identification number instead of an SSN.

So, it’s essential to thoroughly research the requirements of the specific platform or marketplace to sell on to ensure compliance with their policies and guidelines.

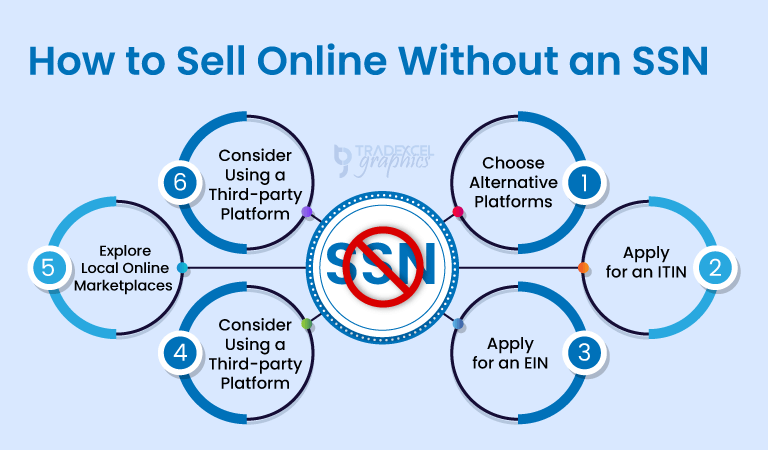

Not all online sellers are from the USA. Therefore, not all of them have an SSN. So, there are many ways to sell online without a Social Security number. To sell online without providing an SSN, you can follow these tricks:

Look for online marketplaces or platforms that do not require an SSN to open a seller account. Some platforms may allow you to use an Employer Identification Number (EIN) or simply verify your identity through other means.

If you haven’t secured an SSN but own an ITIN, then you can use your ITIN instead of the SSN on some platforms.

An Indicate Taxpayer Identification Number, or ITIN is a tax processing number signed by the Internal Revenue Service (IRS) in the United States.

It is used for individuals who are required for a U.S. taxpayer identification number but are not allowed to have a Social Security Number.

In this situation, you will have to apply for an ITIN. To apply for an ITIN, here is the procedure you should follow:

If the platform requires an EIN instead of an SSN, you can apply for one from the Internal Revenue Service (IRS). But this is eligible when you have a legal business entity.

The EIN will serve as a tax identification number. Note that applying for an EIN may require you to give your personal information. To apply for an EIN, here are the steps to follow:

Another option is to sell your products or services through a third-party platform. You can sign up as a seller on websites like Etsy, eBay, or Amazon, which often do not require an SSN.

Depending on your location, there may be local online marketplaces or classified websites where you can sell without providing an SSN. Research and identify such platforms in your region.

This is another significant way to sell online without a Social Security Number. Implement a payment gateway that doesn’t require an SSN.

Platforms like PayPal and Stripe allow you to accept online payments without providing an SSN, although they may still require you to verify your identity using other methods.

Selling online without an SSN (social security number) depends on the platform and the jurisdiction you are operating in.

Generally, for individuals in the United States, it is advisable to have an SSN when conducting online business.

Because it may be required for tax purposes and to comply with applicable laws and regulations, such as reporting income.

However, some online platforms may allow you to sell without providing an SSN by using alternative identification methods, as we mentioned earlier.

Hence, it is important to review the platform’s policies and understand any legal obligations you may have before conducting online sales.

If you have specific concerns about selling online without an SSN, it is recommended to consult legal or financial professionals familiar with your jurisdiction’s requirements.